City of Glen Cove/IDA Receive Vision Long Island 2023 Smart Growth Award

City of Glen Cove/IDA receive Vision Long Island 2023 Smart Growth Award for its partnership with Georgica Green and RXR for the affordable rental housing project located at 100 – 200 Dickson Street in Glen Cove. Click here for award presentation article.

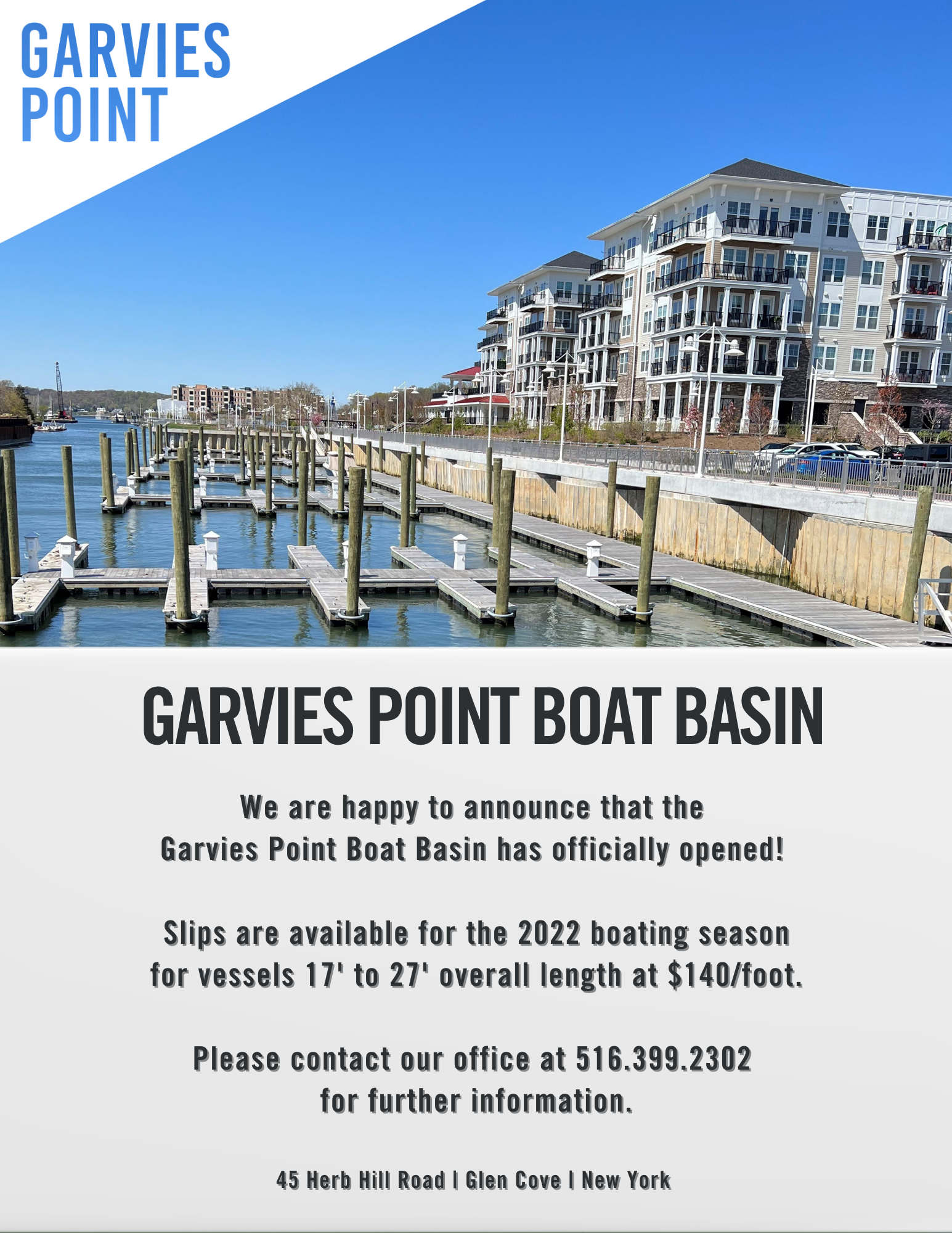

6/21/23: GARVIES POINT MARINA NOW HAS KAYAK & PADDLEBOARD LAUNCH FOR GLEN COVE RESIDENTS

For more information, click on the link:

GARVIES POINT KAYAK-PADDLEBOARD LAUNCH PRESS RELEASE – 6-21-23

Garvies Point Affordable Rental Lottery

Garvies Point Affordable Rental Lottery

Applications now available for Affordable Apartment Rentals at Garvies Point. Applications must be postmarked by April 17th, 2023. Lottery will take place May 1, 2023 at 12:00 pm at the Hilton Garden Inn, 3 Harbor Park Drive, Roslyn, NY 11050

Below is a list of developments financed by HCR’s Housing Finance Agency that are currently holding lotteries or accepting applications.

Please note, HCR does not conduct lotteries or maintain waiting lists for affordable housing and does not receive applications from prospective tenants; that is the sole responsibility of the building owner.

The marketing and lease-up of affordable apartments in developments financed by HCR are the responsibility of the building owner and it is subject to strict rules and in some instances, federal regulation.

Lottery – Garvies Point

Address: 500 & 700 Dickson Street, Glen Cove, NY (Nassau County)

Deadline: April 17, 2023

Click below to view Lottery information.